Overview of Senior Secured Loans

Senior Secured Loans (SSL), commonly referred to as bank loans or floating rate loans are short term debt obligations issued by banks and private corporations. These loans are typically made to companies that have below-investment grade credit ratings. Companies use this loans to finance an expansion, fund an acquisition or for general corporate purpose. Another reason for using such loans is for the purpose of ‘Recapitalization’, a process of making company’s capital structure stable by restructuring its debt and equity mixture. Maturities of these loans ranges from 3 to 5 years, sometimes extending till 8 years. In SSL, there is an option for borrowers to repay the loan prior to the maturity as these loans do not have a non-call period.

The institutional market for these loans developed after 1980 due to progressive development of loan trading as well as improved transparency standards. In 1990s, banks started to reduce their exposure to leveraged loans due to varied reasons, including bank consolidation, shift in their strategy and tighteing of regulatory capital requirement changes like Basel II. The transfer of loan ownership occurred in the context of widening institutional investor appetite for the asset class, resulted in improving transparency, data standardisation and secondary liquidity. This created a substantial shift in the ownership profile of senior secured loans towards mutual funds, separate managed accounts (SMAs), commingled funds and, most notably, CLOs.

In 1992, Credit Suisse provided a benchmark in the form of Credit Suisse Leveraged Loan Index to track the performance of floating rate loans. Since the 1990’s, new issues and secondary market trading of leveraged loans has significantly increased among many of the larger investment banks and money managers. The market of institutional loans outstanding stood at approximately USD 955 billion in December 2017 with average issuance of USD 375 billion per year since 2007.

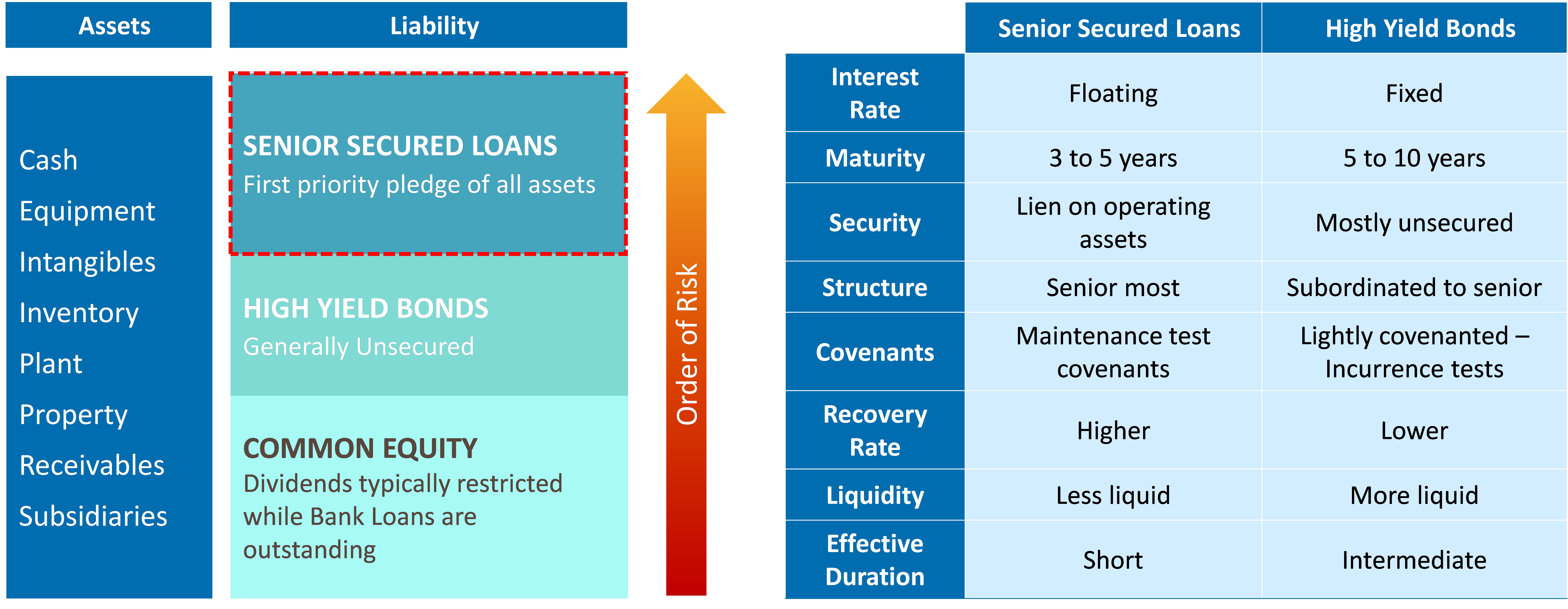

Diagram 1: Capital structure and key difference between Senior Secured Loans vs Bonds:

Source: Livermore representation

Key Characteristics of SSL

Seniority in the structure – This unique characteristic of SSL and its placement in capital structure sets them apart from high yield bonds. These loans sit at the top of the capital structure, which means that they have highest priority claim on the borrower’s assets. If the company goes insolvent, these loans get priority in repayment before other claimants and they are in better positon to maximize recovery. SSL ranks above unsecured high yield bonds, mezzanine debt and equity when it comes to claims. These loans are secured by major operating company’s assets and other critcal assets. Majority of loans have first lien priority against assets at the time of default, however some loans may have second lien priority. These atribute makes the loan quite secure even during recessions or during negative events effecting the borrowing company.

Covenants - SSL agreements have series of safeguards to protect the lender’s interest, commonly known as covenants. Covenants are put in place to red flag if the probablity of default is increasing and to take corrective steps before any actual default takes place. Covenants allows the lender to ensure that borrower must maintain certain measures of financial position. Syndicated loans typically benefit from financial maintenance covenants in addition to incurrence covenants. In contrast, high-yield bonds typically have access only to incurrence covenants, which are triggered if the borrower attempts to incur additional debt while certain financial requirements are not being met and therefore do not provide the same continual downside protection to lenders that maintenance covenants do.

There are mainly three types of covenants:

- Affirmative covenants state actions that should be taken from borrower’s part to be in compliance with the loan. Such action may be to pay the bank interest and fees, payment of taxes, maintenance of insurance, to provide audited financial statements, among others.

- Negative covenants limit the activities of borrowers. They are highly structured and customized as per specific conditions of borrowers. The limitations are usually on type and amount of investment and disposition of debt, assets or guarantees and liens.

- Financial covenants require that during the life of the loan, borrowers must maintain certain financial benchmarks, typically measured on quarterly basis. For example, financial coverage ratio and leverage ratio test. Financial covenants are further classified as maintenance covenants and incurrence covenants.

Low correlation with other FI instruments – Historically, SSLs have low or even negative correlation as compared to other FI instruments. This is primarly due to the fact that SSLs tends to outperfrom other FI assets during any crises. Also during rising rate scenario, its floating rate attributes, self correct the returns. Addition of SSL in a debt portfolio can provide diversification benefit while lowering the overall risk and potentially increasing the return per unit of risk undertaken.

Natural hedge to inflation – SSLs are typically floating-rate instruments with their coupons reset periodically, while high-yield bonds are generally fixed-rate instruments, exposing them to greater interest rate risk than loans. It provides a SSL investor a natural hedge against inflation. With changing market conditions the interest rate also changes accordingly, thus keeping the prices more stable. Also the average duration of a SSL is less than 3 years, which also makes it’s price less sesitive to changing market rates and thereby providing a stable return.

Among other key charactertics of SSL is that it has an active secondary market where these securities are easily traded, providing a continuous market for buyers and sellers. With increasing restrictions and guidelines from regulators, SSLs have become more generic and standard. This gives comfort to the investors looking at SSL as an attractive investment and a product to add to their portfolio.

Performance:

Historically SSLs have experienced lower default and higher recovery rates. Liquidity has also improved in recent years as daily trading volume have improved. These loans have performed convincingly well in all phases of business cycle.

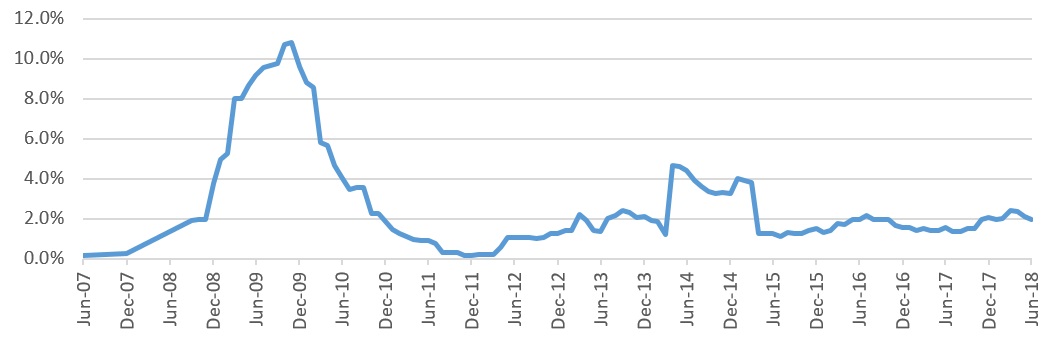

Low default rates: Historically SSLs have experienced lower default rates as compared to other asset classes. There was an exception in 2007-08 when the market was hit with crisis. But even after that phase, default rate remained relatively low. Default rate has averaged approximate 2.8% after 2007. One of the reason it enjoys low defaults is that it is secured with companies assets.

Chart 1: US SSL Default Rates

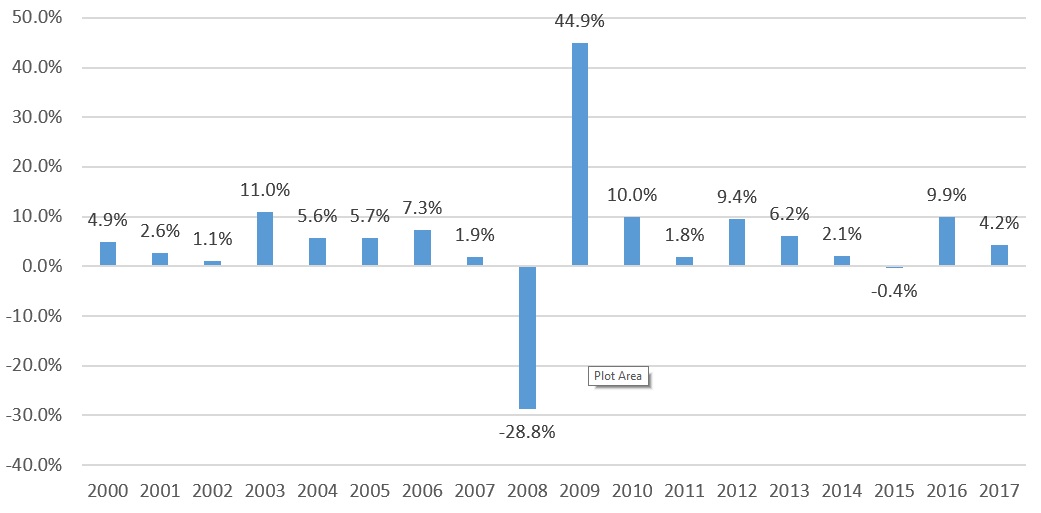

Consistant Returns: SSLs has provided stable returns since the time it has been tracked by Credit Suisse’s Leveraged Loan Index. It has recorded a positive return in each calendar year apart from 2008, as returns were negative due to adverse situation of the market. After that it made a stable comeback and has provided an average of 5.6% of annualized return.

Chart 2: Senior Secured Loans Total Return

Higher recovery rates: SSL tends to provide higher recovery rates as these loans are senior in nature and they are secured against assets of the companies. Holder of the SSL receives first lien priority claims amongst the creditors. According to Moody’s report, over the 20-year period of 1998-2017, ‘first lien’ senior secured loans (the highest priority debt in the case of default) have experienced an average recovery rate of 67.4% versus 41.3% for high-yield bonds.

Low volatility in prices: SSLs have low price volatility as compared to other asset classes with annual price volatility have been recorded at 2-3%. The volatility spiked higher during the crisis period of 2008 but it got stabilized after a period of 12 months. Another reason which contributes to low price volatility is that these loans are secured and placed higher in the capital structure.

Risks Associated with SSL:

As SSLs have non-investment grade status, investment in such loans is considered to be speculative. Like all other investment classes there are risks associated with investing in a portfolio of senior loans. The default risk is simply the possibility that borrower may not able to pay interest or principal on time. This is also known as credit risk. Even though these securities pays higher interest rates there is no guarantee that the value of the collateral will be sufficient to repay the loan. Another risk associated with SSL is Call risk. When market spreads declines, senior loans are likely to be called by the issuers and refinanced at lower spreads.

Senior Secured Loans

Balance, Potential, Value, Think, Globally-act Locally

Our investments is a reflection of our values and course of action.

CLOs offer investors multiple advantages.

Visualtools.net

Visualtools.net